Debt Relief Articles

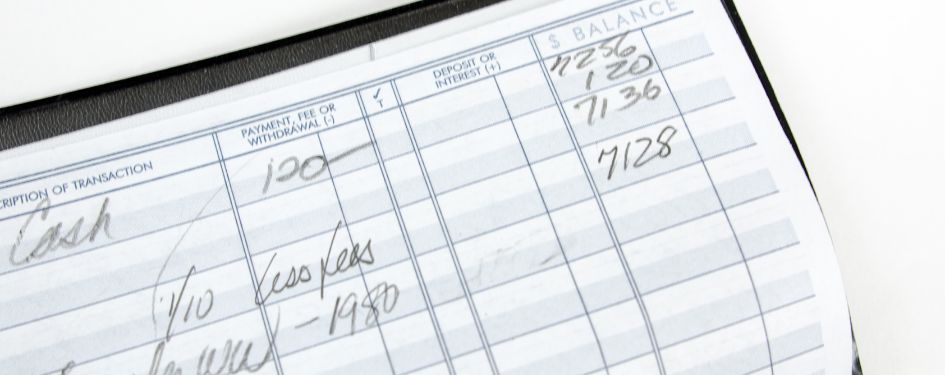

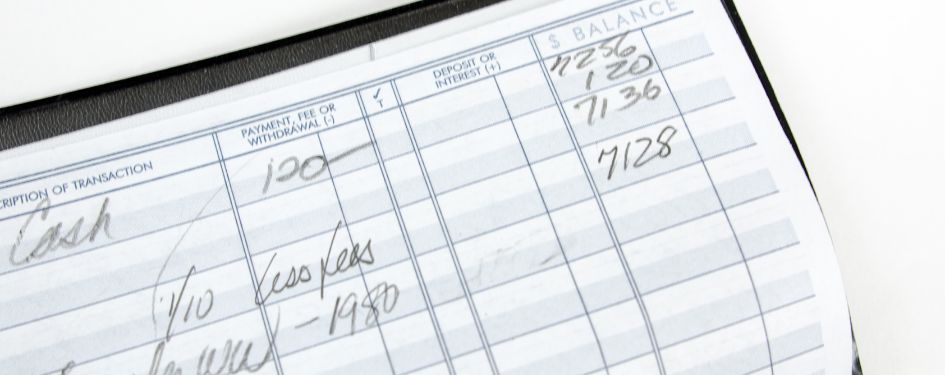

How To Calculate Compound And Simple Interest

Updated Oct 05, 2023

By Melissa Cook

Understanding how to calculate compound and simple interest is like possessing a financial compass—it helps you plan your financial goals...

Read More

Understanding how to calculate compound and simple interest is like possessing a financial compass—it helps you plan your financial goals...

Read More

Understanding how to calculate compound and simple interest is like possessing a financial compass—it helps you plan your financial goals...

Read More

Understanding how to calculate compound and simple interest is like possessing a financial compass—it helps you plan your financial goals...

Read More

How To Pay Back Your Student Loan Refund Check

Updated Oct 05, 2023

By Minh Tong

Student loan borrowers who received refunds of voluntary payments made during the interest-free payment pause are now required to cover...

Read More

Student loan borrowers who received refunds of voluntary payments made during the interest-free payment pause are now required to cover...

Read More

Student loan borrowers who received refunds of voluntary payments made during the interest-free payment pause are now required to cover...

Read More

Student loan borrowers who received refunds of voluntary payments made during the interest-free payment pause are now required to cover...

Read More

Thinking of Refinancing Private Student Loan Debt? Read This First.

Updated Oct 05, 2023

By Aaron Sarentino

If you’re one of the many struggling with private student loan debt, you’ve probably considered refinancing. Refinancing can be a...

Read More

If you’re one of the many struggling with private student loan debt, you’ve probably considered refinancing. Refinancing can be a...

Read More

If you’re one of the many struggling with private student loan debt, you’ve probably considered refinancing. Refinancing can be a...

Read More

If you’re one of the many struggling with private student loan debt, you’ve probably considered refinancing. Refinancing can be a...

Read More

What Is An ACH Transfer? (And Common Misconceptions)

Updated Sep 28, 2023

By Melissa Cook

From everyday transactions to payroll deposits and online bill payments, ACH transfers have simplified the process of transferring funds between...

Read More

From everyday transactions to payroll deposits and online bill payments, ACH transfers have simplified the process of transferring funds between...

Read More

From everyday transactions to payroll deposits and online bill payments, ACH transfers have simplified the process of transferring funds between...

Read More

From everyday transactions to payroll deposits and online bill payments, ACH transfers have simplified the process of transferring funds between...

Read More

What Is A Savings Bond? (The Complete Guide)

Updated Sep 28, 2023

By Minh Tong

Saving money is an important practice of personal finance, and there are various ways to save. One option is investing...

Read More

Saving money is an important practice of personal finance, and there are various ways to save. One option is investing...

Read More

Saving money is an important practice of personal finance, and there are various ways to save. One option is investing...

Read More

Saving money is an important practice of personal finance, and there are various ways to save. One option is investing...

Read More

Saving vs. Investing (What’s The Difference?)

Updated Sep 28, 2023

By Aaron Sarentino

When you understand the key differences between saving and investing can help you make better financial decisions and is essential...

Read More

When you understand the key differences between saving and investing can help you make better financial decisions and is essential...

Read More

When you understand the key differences between saving and investing can help you make better financial decisions and is essential...

Read More

When you understand the key differences between saving and investing can help you make better financial decisions and is essential...

Read More

CD vs Savings Account: How To Make The Right Choice

Updated Sep 28, 2023

By Melissa Cook

The CD vs. savings account debate is popular today as interest rates are high, and consumers wonder how to save...

Read More

The CD vs. savings account debate is popular today as interest rates are high, and consumers wonder how to save...

Read More

The CD vs. savings account debate is popular today as interest rates are high, and consumers wonder how to save...

Read More

The CD vs. savings account debate is popular today as interest rates are high, and consumers wonder how to save...

Read More

Money Market Vs. Savings: Which Is Right For You?

Updated Sep 22, 2023

By Minh Tong

American consumers with extra cash beyond their day-to-day expenses are prudent to consider accounts that not only accrue interest but...

Read More

American consumers with extra cash beyond their day-to-day expenses are prudent to consider accounts that not only accrue interest but...

Read More

American consumers with extra cash beyond their day-to-day expenses are prudent to consider accounts that not only accrue interest but...

Read More

American consumers with extra cash beyond their day-to-day expenses are prudent to consider accounts that not only accrue interest but...

Read More

How Much Money Should You Keep In Your Checking Account?

Updated Sep 22, 2023

By Aaron Sarentino

Maintaining the right amount of funds in your checking account is crucial, as experts advise against having too little or...

Read More

Maintaining the right amount of funds in your checking account is crucial, as experts advise against having too little or...

Read More

Maintaining the right amount of funds in your checking account is crucial, as experts advise against having too little or...

Read More

Maintaining the right amount of funds in your checking account is crucial, as experts advise against having too little or...

Read More

Imagine life completely

free of debt!

or call the number below to speak with

a certified Debt Consultant today: