Debt Relief Articles

5 Ways to Stop Credit Card Collection Calls

Updated Sep 06, 2022

By Aaron Sarentino

If you run into credit card debt, you might be overwhelmed and stressed out by the seemingly never-ending phone calls...

Read More

If you run into credit card debt, you might be overwhelmed and stressed out by the seemingly never-ending phone calls...

Read More

If you run into credit card debt, you might be overwhelmed and stressed out by the seemingly never-ending phone calls...

Read More

If you run into credit card debt, you might be overwhelmed and stressed out by the seemingly never-ending phone calls...

Read More

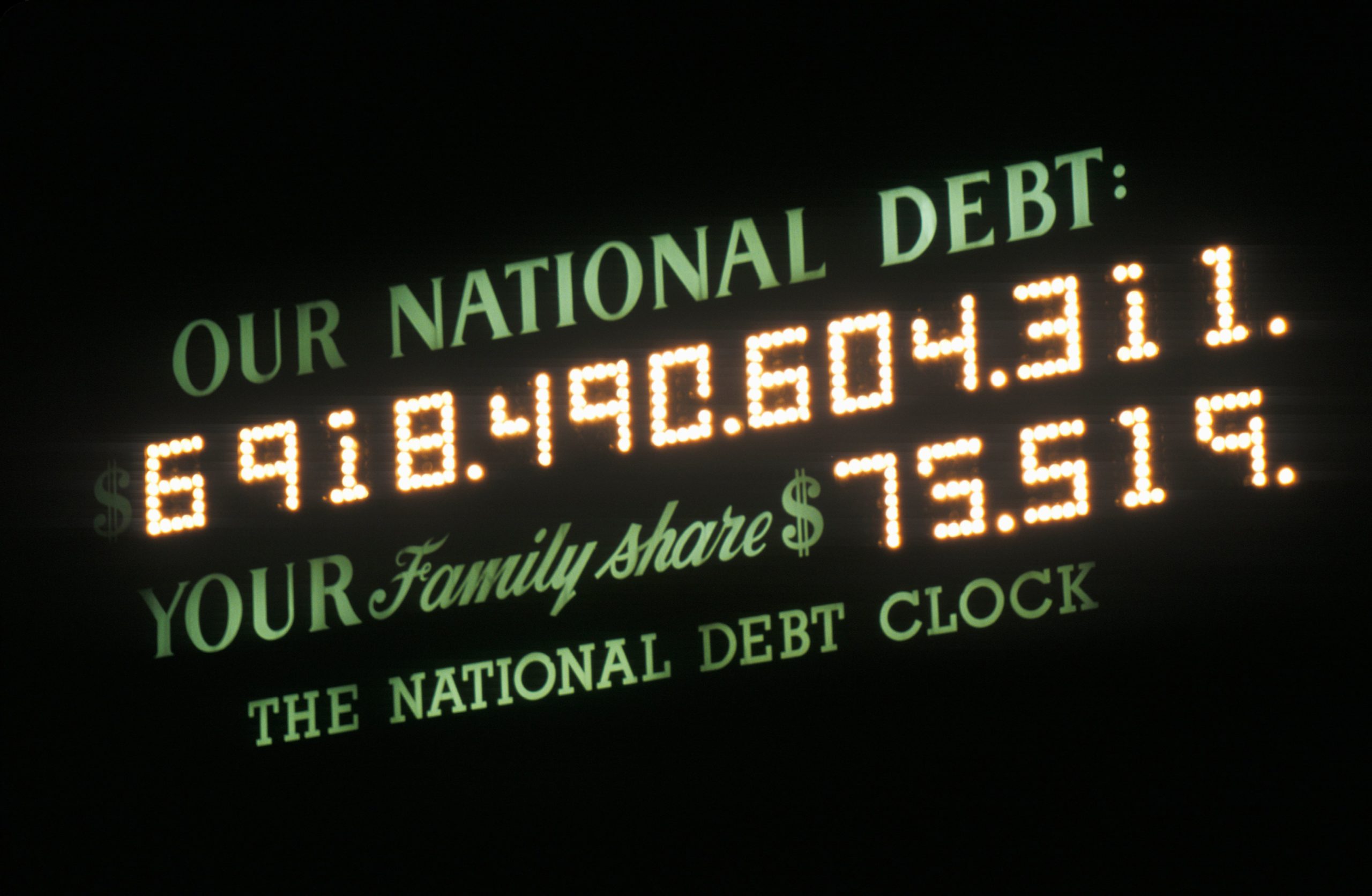

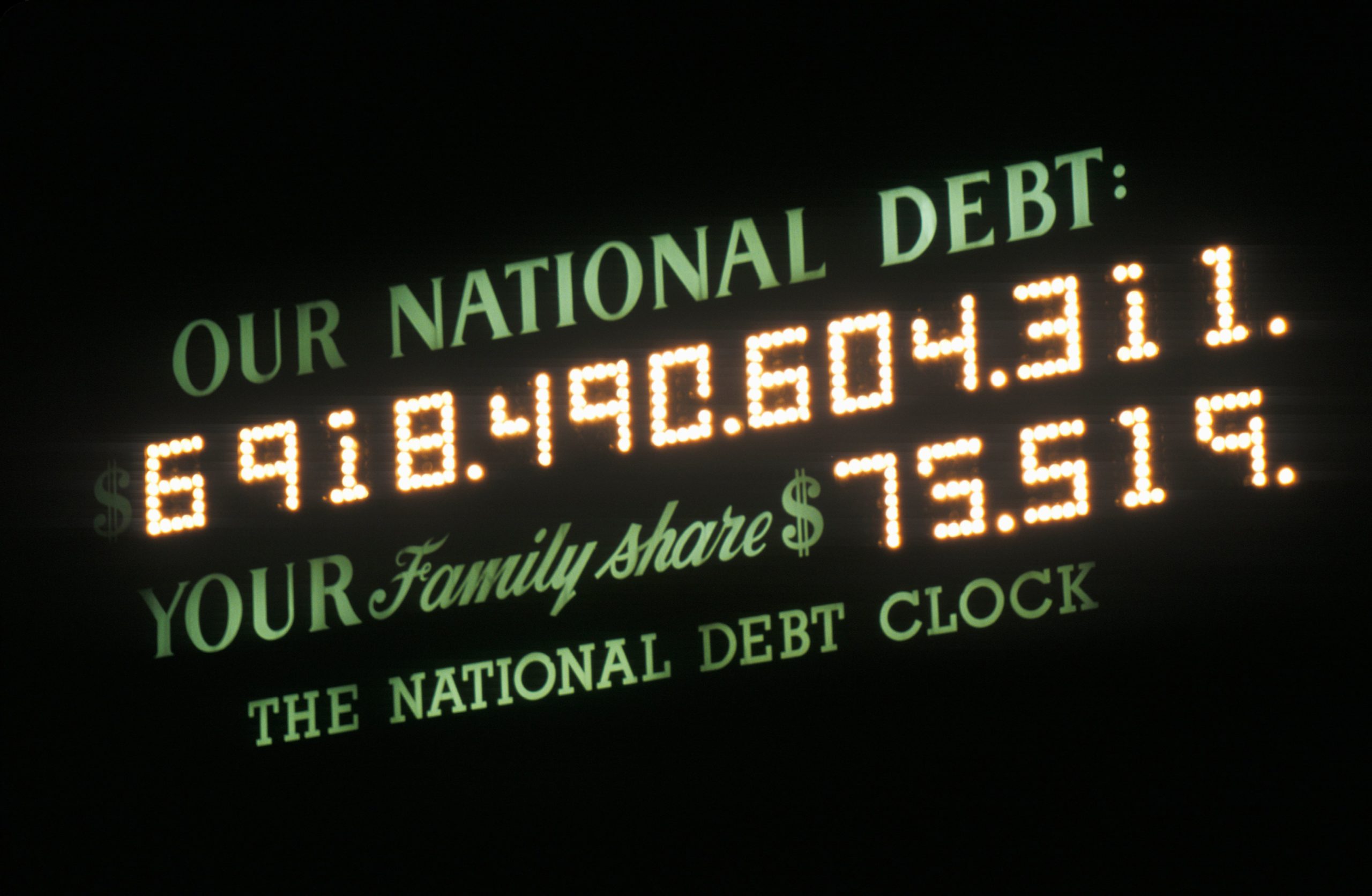

Top 5 Presidents by National Debt

Updated Sep 04, 2022

By Minh Tong

As of 2022, the national debt is estimated to be around $30 trillion! While data from the U.S. Treasury shows...

Read More

As of 2022, the national debt is estimated to be around $30 trillion! While data from the U.S. Treasury shows...

Read More

As of 2022, the national debt is estimated to be around $30 trillion! While data from the U.S. Treasury shows...

Read More

As of 2022, the national debt is estimated to be around $30 trillion! While data from the U.S. Treasury shows...

Read More

5 Warning Signs You Have Too Much Debt

Updated Aug 24, 2022

By Aaron Sarentino

Sometimes, we get carried away or we are confronted with an unexpected financial emergency, and our debt spirals out of...

Read More

Sometimes, we get carried away or we are confronted with an unexpected financial emergency, and our debt spirals out of...

Read More

Sometimes, we get carried away or we are confronted with an unexpected financial emergency, and our debt spirals out of...

Read More

Sometimes, we get carried away or we are confronted with an unexpected financial emergency, and our debt spirals out of...

Read More

How Credit Card Debt Works

Updated Aug 18, 2022

By Aaron Sarentino

If you’re struggling with credit card debt, it can start to feel like a black hole you can never climb...

Read More

If you’re struggling with credit card debt, it can start to feel like a black hole you can never climb...

Read More

If you’re struggling with credit card debt, it can start to feel like a black hole you can never climb...

Read More

If you’re struggling with credit card debt, it can start to feel like a black hole you can never climb...

Read More

Mid-Year Financial Check-Up: 5 Steps to Take Now

Updated Aug 05, 2022

By Aaron Sarentino

Many of us take stock of our finances at the beginning of the year in preparation for tax season, but...

Read More

Many of us take stock of our finances at the beginning of the year in preparation for tax season, but...

Read More

Many of us take stock of our finances at the beginning of the year in preparation for tax season, but...

Read More

Many of us take stock of our finances at the beginning of the year in preparation for tax season, but...

Read More

Best Ways to Get Debt Relief

Updated Jul 18, 2022

By Aaron Sarentino

If your debts have become too demanding and you’re feeling stuck, here are 7 simple steps and strategies you can...

Read More

If your debts have become too demanding and you’re feeling stuck, here are 7 simple steps and strategies you can...

Read More

If your debts have become too demanding and you’re feeling stuck, here are 7 simple steps and strategies you can...

Read More

If your debts have become too demanding and you’re feeling stuck, here are 7 simple steps and strategies you can...

Read More

Consumer Debt in The U.S.

Updated Jul 11, 2022

By Aaron Sarentino

Even as credit card debt has declined, mortgage and auto loan balances have increased dramatically. This trend may continue as...

Read More

Even as credit card debt has declined, mortgage and auto loan balances have increased dramatically. This trend may continue as...

Read More

Even as credit card debt has declined, mortgage and auto loan balances have increased dramatically. This trend may continue as...

Read More

Even as credit card debt has declined, mortgage and auto loan balances have increased dramatically. This trend may continue as...

Read More

Americans Are Accumulating Credit Card Debt at Record Rates

Updated Jun 03, 2022

By Aaron Sarentino

The Federal Reserve reports that as of March 2022, consumer debt is up to over $52 billion. Credit card debt...

Read More

The Federal Reserve reports that as of March 2022, consumer debt is up to over $52 billion. Credit card debt...

Read More

The Federal Reserve reports that as of March 2022, consumer debt is up to over $52 billion. Credit card debt...

Read More

The Federal Reserve reports that as of March 2022, consumer debt is up to over $52 billion. Credit card debt...

Read More

Know your Rights When Dealing with Debt Collectors

Updated Jun 02, 2022

By Aaron Sarentino

Anyone who has received such calls knows it’s not so much a call as it is harassment and abuse. Before...

Read More

Anyone who has received such calls knows it’s not so much a call as it is harassment and abuse. Before...

Read More

Anyone who has received such calls knows it’s not so much a call as it is harassment and abuse. Before...

Read More

Anyone who has received such calls knows it’s not so much a call as it is harassment and abuse. Before...

Read More

Imagine life completely

free of debt!

or call the number below to speak with

a certified Debt Consultant today: