When money is tight, it is essential to take a step back and review what money is coming in (your income) and what dollars are going out (your expenses).

Individuals feel strapped when they spend more money than they are making.

*** SPECIAL NOTE *** – If your credit cards, personal loans, or medical debts have become unmanageable and you owe over $20,000… then go here for debt relief. We can help!

It is essential to understand what expenses are required versus discretionary. For some, a cup of coffee from the local coffee chain at $5.00 is a must. But, really, couldn’t that individual consider making their own brew at home for $1.00 a cup?

The Key To Having A Budget That Makes Sense

The key to a budget is tracking expenses and categorizing them as needs (i.e. insurance, housing, transportation, electricity, food, medicine, work clothing, and minimum payments on debt) and wants (i.e. travel, entertainment like movies, restaurants, the newest cell phone or game station, non-work clothing).

But on top of that, a budget needs to carve out some savings for retirement (down the road), or perhaps a rainy day (i.e. car breaks down, need a new air conditioning, need

a new refrigerator).

When it comes to paying off debt, you should normally prioritize secured debts, which are loans that are secured by some sort of property.

For example, a car loan is secured by a vehicle, and if you stop making payments, the lender can repossess the car, which could have all sorts of negative effects. Without a car, you may have difficulty getting to work. And if you can’t work, you can’t earn money to pay for your needs.

A home loan is usually secured by a house. So, if you stop making payments, a bank could foreclose and take your house.

There are a number of tools online that have spreadsheets where you can fill in your income and expenses to help you fully understand your current budget. From there, you can highlight your needs vs. wants.

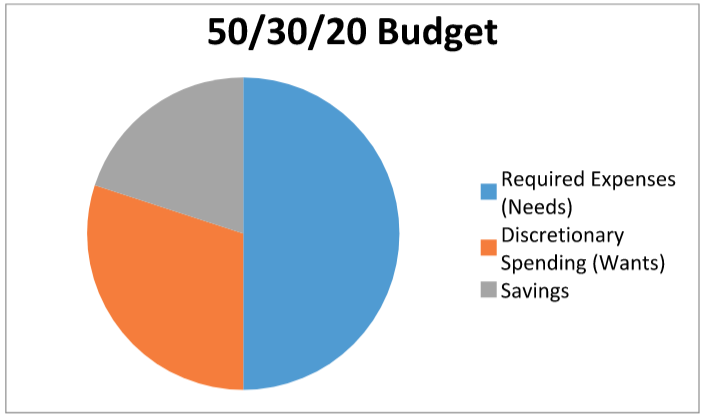

There are a variety of ways to budget. One method that is easier to visualize and places emphasis on savings is known as a 50/30/20 budget. Below is a pie chart that shows it.

Once you set up a spreadsheet, you can see how close you can get to the numbers in the 50/30/20 budget.

And remember, budgets can be fluid. Perhaps an unexpected expense comes up. That may require limiting other expenses in your budget.

For that reason, it is always good to have a monthly budget review so that you can track spending.

And if you want to be more current in tracking spending, consider downloading an App such as Mint where you can tie your bank accounts and credit cards to see daily spending habits. The App even categorizes expenses.

At Americor, we understand the unique financial challenges people are facing today.

As America’s trusted source for debt relief solutions, we aim to empower you with financial knowledge that can lead to informed decisions, whether it’s about savings, investments, or managing debt.

If your debt has become unmanageable and you have difficulty making your debt payments each month, then you should consider a FREE consultation call with one of our certified Debt Consultants, who can provide personalized debt relief advice tailored to your specific needs.

By taking proactive steps today, you can put an end to your financial stress and work towards a brighter financial future.

Remember, there is always hope for debt relief, and our team of experienced professionals are ready to guide you on your journey to regaining control of your finances.

For more information on Americor’s debt relief services, contact us today to see how we can help you eliminate your debts, and get on the fast-track to becoming completely debt-free!