Top 5 Presidents By National Debt Increase

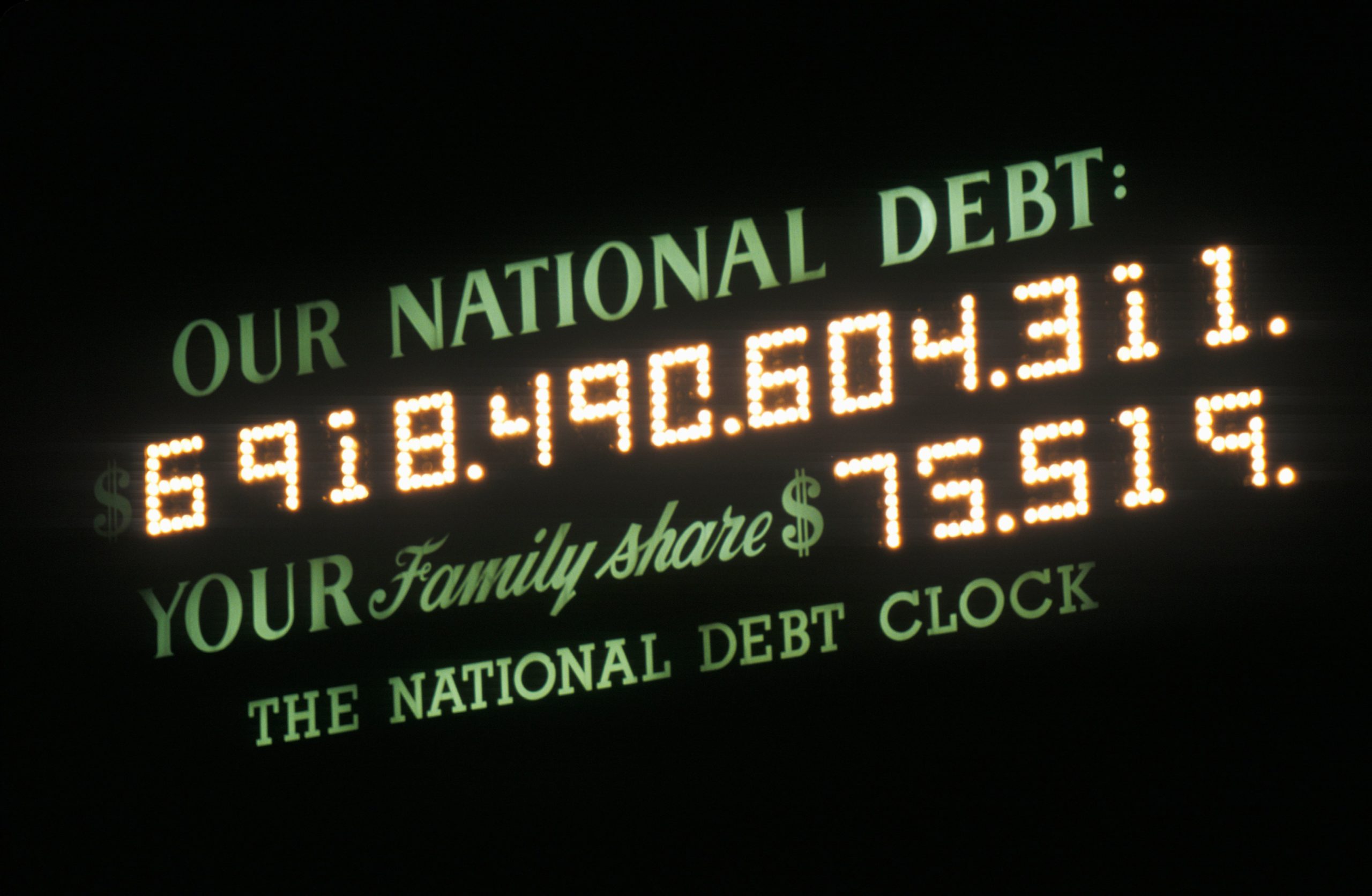

The national debt is the amount of money the government owes to its creditors.

The U.S. government has been in debt since 1790, when it first borrowed $75 million from foreign investors to help pay for the Revolutionary War.

Since then, U.S. presidents have passed accumulating debt from one presidential cabinet to the next.

*** SPECIAL NOTE *** – If your credit cards, personal loans, or medical debts have become unmanageable and you owe over $20,000… then go here for debt relief. We can help!

As of 2022, the national debt was estimated to be around $30 trillion and growing.

While data from the U.S. Treasury shows that not all presidents contributed equally to the national debt, historians often debate which president added the most debt.

Below, we’ve ranked the top 5 presidents according to the percent of the national debt they contributed during their term compared to their predecessors.

Top 5 Presidents Who Added The Most National Debt (By Percentage)

#1 – Franklin D. Roosevelt

Franklin D. Roosevelt increased the national debt by 1,048% compared to his predecessor President Herbert Hoover.

While World War II was the biggest expense contributing to debt, FDR’s New Deal and The Great Depression also played a part. FDR served from 1933-1945.

#2 – Woodrow Wilson

Woodrow Wilson served from 1913-1921 and increased the national debt by 723% compared to William Howard Taft, the previous president.

Like FDR, World War I expenditures were the biggest culprit contributing to the national debt during this time.

#3 – Ronald Reagan

Ronald Reagan had a plan to reduce the national debt.

In the 1980s, Reagan’s supply-side economics program was launched and reduced taxes for companies.

However, the program’s financial success was offset by lost revenue from those tax cuts, resulting in a 186% national debt increase. Ronald Reagan served from 1981-1989.

#4 – George W. Bush

George W. Bush increased the national debt by an estimated 100% during his term from 2001-2009.

The driver of these debts can be attributed to the September 11 attacks in New York City and the War in Afghanistan, which followed shortly after.

#5 – Barack Obama

Barack Obama grew the national debt by an estimated 74%.

Serving from 2009-2017, Obama inherited the financial repercussions of the Great Recession and passed a stimulus package costing the government around $8 billion.

Today, the national debt continues to grow due to increased spending on programs like Social Security, Medicare, and COVID-19 response measures.

Some sectors of the country are still reeling from the effects of the Great Recession. However, it is still possible for the U.S. government to reduce the national debt over time through measures such as spending cuts and tax increases.

Learn More About Debt

You don’t have to be President of the United States to be familiar with debt.

The truth is, many people carry some amount of debt with them, whether it’s credit card debt, student loan debt, or debt from a personal loan.

No matter how much you owe, it’s never too late to learn how to become debt-free. If you’re ready to make the first step toward financial freedom, contact us today.

At Americor, we understand the unique financial challenges people are facing today.

As America’s trusted source for debt relief solutions, we aim to empower you with financial knowledge that can lead to informed decisions, whether it’s about savings, investments, or managing debt.

If your debt has become unmanageable and you have difficulty making your debt payments each month, then you should consider a FREE consultation call with one of our certified Debt Consultants, who can provide personalized debt relief advice tailored to your specific needs.

By taking proactive steps today, you can put an end to your financial stress and work towards a brighter financial future.

Remember, there is always hope for debt relief, and our team of experienced professionals are ready to guide you on your journey to regaining control of your finances.

For more information on Americor’s debt relief services, contact us today to see how we can help you eliminate your debts, and get on the fast-track to becoming completely debt-free!