How Much Money Should You Keep In Your Checking Account?

Many people disagree on how much money you should keep in your checking account, but here’s what you should know.

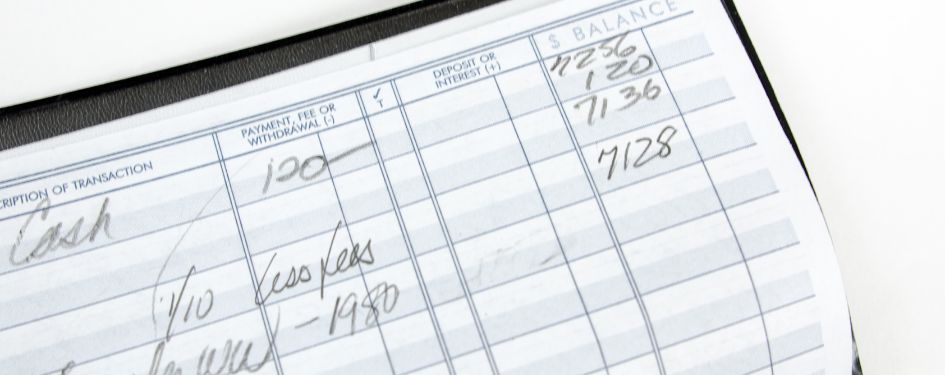

There’s lots of discussion about how much money should be kept in a savings account. But what about a checking account? Most of us use this account on a daily basis.

Maintaining the right amount of funds in your checking account is crucial, as experts advise against having too little or too much.

*** SPECIAL NOTE *** – If your credit cards, personal loans, or medical debts have become unmanageable and you owe over $20,000… then go here for debt relief. We can help!

On one hand, having insufficient funds in your checking account can lead to unwanted overdraft fees. On the other hand, having an excessive amount of money in a low-yield account may mean missing out on valuable interest earnings.

Below, we will explore a common financial question: “How much money should you keep in your checking account?”

KEY TAKEAWAYS:

- Balancing Act – Striking the right balance in your checking account is crucial. Having too much or too little money in your checking account can impact your financial stability.

- Budget Matters – Your monthly budget plays a significant role in determining how much money should stay in your checking account. It provides valuable insights into your spending patterns.

- Savings and Investments – While your checking account is for everyday expenses, don’t forget to allocate funds to savings accounts and investments for long-term financial goals.

Checking Accounts vs. Savings Account

Checking accounts and savings accounts share several similarities, yet they serve distinct purposes. When it comes to managing your finances, the choice of where to allocate your funds for short- or long-term goals holds significance.

Checking accounts are designed for the convenient handling of day-to-day expenses, enabling swift deposits and withdrawals.

On the other hand, savings accounts, particularly those with favorable interest rates, offer a secure avenue to store and cultivate your money over extended periods.

Most banks provide both options, affording you the flexibility to distribute your funds according to your financial objectives.

Given that checking and savings accounts are among the most accessible destinations for your funds, you can divide your resources between them based on your intended expenditure timeline.

Risks Of Having Too Little In Your Checking Account

Insufficient funds in your checking account can result in a range of undesirable consequences.

Here are some potential issues to be aware of:

- Overdraft Fees – If you lack the necessary funds to cover a transaction in your checking account, your bank may impose an overdraft fee. These fees can be substantial, often exceeding $35 for every transaction made while your balance is below $0. If multiple transactions exceed your account balance, these charges can accumulate rapidly.

- Bounced Checks – Writing a check or authorizing a payment that surpasses your available funds will result in the check or payment bouncing. This can lead to additional fees, both from your bank and the recipient of the payment.

- Minimum Balance Requirements – It’s essential to consider the minimum balance required to avoid monthly service or maintenance fees. Some banks offer fee waivers if you maintain a recurring direct deposit or engage in a specified number of debit card transactions.

- Credit Score – Additionally, having too little in your checking account may negatively impact your credit score if a lack of balance leads to missed payments.

In summary, maintaining an adequate balance in your checking account is crucial to avoid these potential financial pitfalls.

More Cash In Your Checking Account Isn’t Always Better

It’s a common misconception that keeping a large sum of money in your checking account is a sign of financial security.

While you should have enough funds to cover your expenses, excess cash in your checking account might not work to your advantage.

Your checking account is your transactional account. Money in your checking account typically earns low or zero interest, which means it’s not growing. According to the FDIC, the average checking account has an interest rate of 0.07 percent.

It’s worth noting that debit cards generally offer limited consumer protections against fraud. And while the risk of theft is relatively low, it’s essential to acknowledge that the funds in your checking account are vulnerable through your debit card.

In the event your card is misplaced or stolen, unauthorized purchases or ATM withdrawals could deplete your account.

Signs You’re Keeping A Lot Of Money In Your Checking Account

Here are some signs that you might be keeping more money in your checking account than necessary:

- You consistently maintain a balance well above your monthly expenses

- Your checking account balance remains unchanged for an extended period

- You’re missing out on higher interest rates by not investing or saving your excess funds

Checking Account: 1-2 Months Of Expenses

When figuring out how much cash to keep in your checking account, it helps to know how other people approach it.

Based on The Federal Reserve Survey of Consumer Finances, the median balance in an American checking account hovers around $2,900.

However, it’s important to note that this figure may not be the right fit for everyone.Financial situations vary widely, leading to different answers regarding the ideal checking account balance.

A common guideline is to aim for maintaining 1-2 months’ worth of daily living expenses in your checking account since it’s the ‘operating account’ that bills are paid out of. Some financial experts even suggest adding an extra 30 percent to this amount as a safety cushion.

To determine your precise living expenses, it’s advisable to track your spending over several months, encompassing all regular bills and discretionary spending. Don’t forget to account for seasonal and occasional expenses to arrive at a more accurate figure.

A Budget Can Tell You How Much To Keep In Checking

Your budget is your financial compass. It tells you exactly how much money you need to cover your monthly expenses.

Review your budget to determine the minimum balance required in your checking account to meet your regular bills, including rent or mortgage, utilities, groceries, and transportation.

Put Extra Cash In A High-Yield Account

Not everyone fully recognizes the substantial role that savings accounts can play in the growth of personal wealth.

An analysis by The Wall Street Journal, using data from S&P Global Market Intelligence, revealed that savers could have collectively earned an additional $42 billion in interest during the third quarter of 2022 by choosing high-yield savings accounts over conventional accounts offered by major banks.

Rather than leaving excess funds in your checking account, consider moving them to a high-yield savings account or other interest-bearing accounts. As of September of 2023, the best interest rate on a high-yield savings account is 5.3 percent.

This way, your money can work for you, earning interest and potentially growing over time.

Don’t Forget Investments

While your checking account is for immediate needs and savings account for short-term needs, long-term financial stability requires strategic investments.

Put your extra money where it might have an opportunity to grow and accumulate faster.

Consider investing in retirement accounts, stocks, bonds, or other investment vehicles aligned with your financial goals. It’s essential to diversify your financial portfolio to achieve financial security.

Conclusion About How Much Money Should You Keep In Your Checking Account

Balancing your checking account is a fundamental aspect of financial management. By keeping the right amount in your checking account, you can ensure that your everyday expenses are covered while also maximizing the growth of your savings and investments.

A general guideline is to keep 1-2 months’ worth of daily living expenses in your checking account. This provides a buffer to cover your regular bills and unexpected expenses. Beyond this, consider moving surplus funds to more interest-earning accounts.

At Americor, we understand the unique financial challenges people are facing today.

As America’s trusted source for debt relief solutions, we aim to empower you with financial knowledge that can lead to informed decisions, whether it’s about savings, investments, or managing debt.

If your debt has become unmanageable and you have difficulty making your debt payments each month, then you should consider a FREE consultation call with one of our certified Debt Consultants, who can provide personalized debt relief advice tailored to your specific needs.

By taking proactive steps today, you can put an end to your financial stress and work towards a brighter financial future.

Remember, there is always hope for debt relief, and our team of experienced professionals are ready to guide you on your journey to regaining control of your finances.

For more information on Americor’s debt relief services, contact us today to see how we can help you eliminate your debts, and get on the fast-track to becoming completely debt-free!