Average Credit Score By State: How Does Yours Stack Up?

It’s been over two years since the coronavirus pandemic upended life as we knew it and put millions of Americans into a state of financial turmoil.

With the recent interest rate hikes, spiking consumer prices, and continued record inflation, how are Americans’ finances faring today?

*** SPECIAL NOTE *** – If your credit cards, personal loans, or medical debts have become unmanageable and you owe over $20,000… then go here for debt relief. We can help!

Credit reporting agency Experian, one of the three biggest credit reporting agencies, sought to find out with their latest State of Credit study.

Knowing the average credit score by state can help you:

- See how you compare to residents of other states

- Learn more about how you’d fit in economically if you’re considering a move to a certain state

- Assess business opportunities within a state

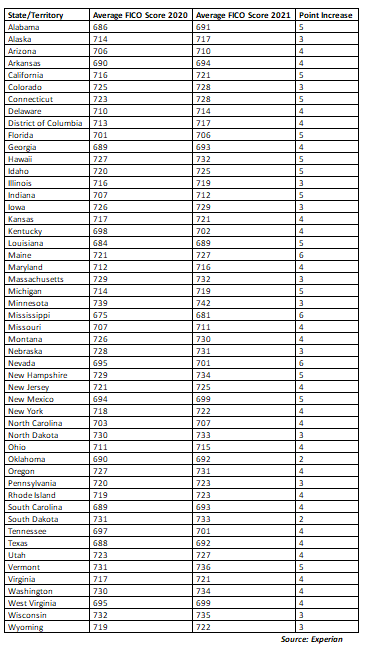

2021 Credit Score Rankings by State

As part of their annual study, Experian surveyed today’s consumer credit behaviors ― including how credit scores compare among the 50 states.

The top five spots were taken by these states: Minnesota, Vermont, Wisconsin, New Hampshire, Washington, and North Dakota, with average credit scores of 733 or higher.

Mississippi, Louisiana, Alabama, Oklahoma, Texas, and Georgia took the five lowest spots, with average scores below 693.

Credit utilization is one clear factor that influenced the scores. Defined as the ratio of the amount of credit you’re using compared to your credit limit, the utilization rate on revolving accounts is higher in the states with the worst average scores.

Besides credit utilization, other factors that influenced these scores include job markets, education levels, cultural approaches to using credit, etc.

Credit Scores On The Rise

The report pointed out that despite financial troubles caused by the pandemic, the national average credit scores increased in 2021.

Credit scores have been rising in America for the last few years. The FICO score national average hit a record high of 714 in 2021, which represents a 4-points increase from 2020.

No state had an average credit score that was below the “Good” category.

Mississippi, Nevada, and Maine grew the most from 2020 at 6 points each, while 12 states all grew by 5.

NB: The VantageScore national average also rose from 688 in 2020 to 698 in 2021.

What’s Driving The Growth?

Despite the harsh economic conditions and rising unemployment, Americans, especially millennials and Generation X, saw an improvement in credit scores.

The nationwide growth was due, in part, to:

- Consumer confidence has grown as Americans have generally become more financially literate. The result of consumers becoming more confident in their financial situation is using credit as a financial tool.

- A lower percentage of Americans have higher credit utilization on their credit cards. The average credit card utilization ratio in 2021 was 25.3 percent.

- Fewer missed payments among consumers. Only 1.67 percent of all credit card accounts were in some stage of delinquency.

- Also, government assistance programs appeared to help consumers further decrease credit card balances and stay current on their other debt obligations.

What’s A Good Credit Score

A credit score is a 3-digit number that lenders, landlords, and employers use to determine your credit worthiness.

The five key factors used to determine your FICO score are:

- Payment history (35 percent)

- Amounts owed (30 percent)

- Length of credit history (15 percent)

- New credit accounts (10 percent)

- Types of credit used 10 percent)

Positive info stays on your credit reports for up to 10 years, while negative items stick around for up to 7 years.

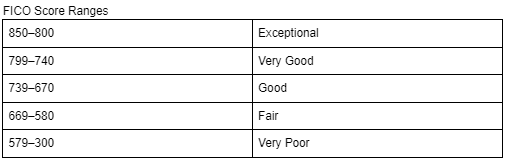

The lowest credit score is 300, while the highest possible score is 850. Rather than each score having an exact value, credit scores fall within 1 of 5 possible ranges, which provides an easy reference for your financial health.

A person with a credit score of 670 or above, which is considered “Good,” will have a much easier time qualifying for a loan than one with a credit score of 669 or below.

It’s worth mentioning that creditors may define their own ranges, loan breakdowns, making it possible to technically have more than one credit score.

The ranges in the table above, however, are the ones most frequently used due to the market domination of the FICO scoring model. The model is used in over 90 percent of United States lending decisions.

Why Is Credit Score So Important?

The numbers that make up your credit score affect almost every aspect of your financial life.

Whether you’re applying for a mortgage loan, a credit card, or an auto loan, lenders consider having a higher credit score as a sign that you’re more likely to repay their debts. Even cell phone companies, employers, and landlords consider your credit score when you’re getting approved.

Not only can your credit score affect whether or not you’ll qualify for insurance or a loan, but it can also affect how much you will pay overall.

If you have a lower credit score, you might be approved but be charged higher premiums and interest rates to account for the increased risk to lenders. That could translate to big bucks over time.

Ways To Improve Your Credit Score

You can work toward improving a bad credit score and clear your credit score or keeping your current one strong no matter where you live.

To do this, be sure to:

- Make timely payments

- Lower your credit utilization ratio

- Increase your credit limit

- Balance your credit mix

- Apply for new credit only as needed

- Keep your old accounts open

- Become an authorized user

- Consider applying for a secured credit card

- Review your credit report and report any errors or outdated info

- Use credit-building tools

Read our post on denial of credit and what is the Fair Credit Reporting Act (FCRA).

At Americor, we understand the unique financial challenges people are facing today.

As America’s trusted source for debt relief solutions, we aim to empower you with financial knowledge that can lead to informed decisions, whether it’s about savings, investments, or managing debt.

If your debt has become unmanageable and you have difficulty making your debt payments each month, then you should consider a FREE consultation call with one of our certified Debt Consultants, who can provide personalized debt relief advice tailored to your specific needs.

By taking proactive steps today, you can put an end to your financial stress and work towards a brighter financial future.

Remember, there is always hope for debt relief, and our team of experienced professionals are ready to guide you on your journey to regaining control of your finances.

For more information on Americor’s debt relief services, contact us today to see how we can help you eliminate your debts, and get on the fast-track to becoming completely debt-free!