Julie H.

Two-time breast cancer survivor, saved $43,173 with our Americor debt consolidation program

Consolidate and reduce your minimum payments into one, low monthly payment that fits your budget.

Our fees are entirely performance-based. We don’t get paid until your debts are settled, per FTC regulations.

With our expert team of negotiators, we can help you become debt-free faster than you ever thought possible!

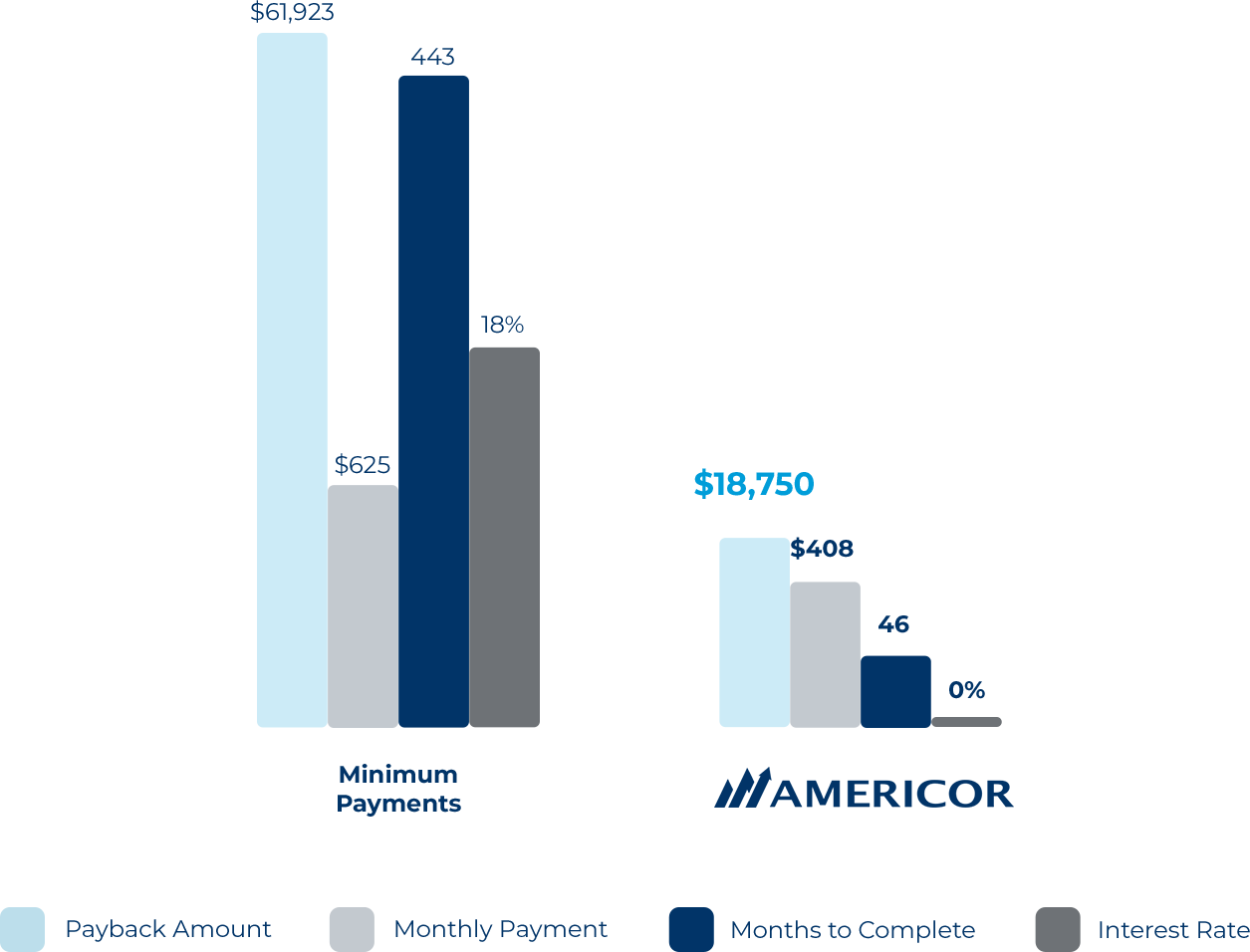

If you had $25,000 in credit card debt, were charged 18% interest, & paid only the minimum each month ($625), it would take 443 months (36 years!) to pay off, & cost you $36,923 in interest!

With our program, you could pay it off in less than 48 months, & only pay $18,750. Plus, save over $200 each month!

Two-time breast cancer survivor, saved $43,173 with our Americor debt consolidation program

STARTING DEBT

Americor’s debt consolidation program can help you with the following types of unsecured debts – debt that is not backed by collateral such as a house or car.

Debt consolidation isn’t right for everyone. That’s why we evaluate your debt situation to help ensure that debt consolidation is the right option for you.

Our team of experienced negotiators are committed to getting you the best debt settlements from thousands of creditors.

Every day of the week, our certified Debt Specialists are ready to provide the answers and support you need.

Americor’s debt consolidation program was created to resolve your debt for a fraction of what you owe, as quickly as possible.

First, we provide a free debt consultation with one of our certified Debt Specialists to review various debt consolidation options you have including bankruptcy, debt settlement, and debt consolidation. Then we help you decide what form of debt consolidation and our program specifically is right for you.

If you decide that it is, we work with you to design a personalized debt resolution program that fits your goals and your monthly budget. Many Americor clients find this is often lower than their existing minimum payments!

Once you enroll, Americor’s expert debt negotiators work on your behalf and negotiate with your creditors, so that we can help you become debt-free as quickly as possible.

For many people, it certainly can be!

If you’re living paycheck-to-paycheck, carrying high balances on your credit cards, and struggling to make the minimum payments… then you’re also likely experiencing unnecessary stress that can affect both you and those close to you.

When you enroll in Americor’s debt resolution program, not only will we help you eliminate your debt and regain control of your finances, but you’ll also find yourself free of the stress, guilt, and worry that comes with overwhelming debt. That means you’ll have time to focus on what really matters: your family… your career… your hobbies and pastimes… and enjoying life to the fullest!

We offer debt consolidation loans to qualified individuals/couples for up to $45,000 through our partner, Credit9.

If you live in a state we service and you are struggling with more than $7,500 of unsecured debts, including credit cards, medical bills, department store and personal loans… then you qualify for Americor’s debt consolidation program.

It depends on a variety of factors including how much debt you have, what your income is, and who your creditors are.

However, on average, it typically takes between 20-48 months to become debt-free with our debt resolution program.

So if you compare that to only make the minimum payments on your credit cards, you could remain stuck in debt for the next 10-20 years or more and have to and pay back 2-5 times the amount you originally borrowed… making Americor’s debt resolution program a smart choice!

Americor has helped over 200,000 individuals and families get out of debt faster than they ever imagined, and for far less than what they owed!

With an A+ rating with Better Business Bureau (BBB), we at Americor are proud to share that we’ve relieved over $2 billion worth of debt – and we’re excited for the opportunity to help you on your journey to becoming debt-free.

Check out our many client stories, case studies containing real settlement letters we’ve negotiated for our clients, and our online reviews.

or call the number below to speak with

a certified Debt Consultant today: