Pennsylvania Debt Relief Program

How much do you owe?

Debt Help For Pennsylvania Residents

Residents of Pennsylvania know how much the state has to offer. From the Gettysburg National Military Park to Hershey Park, Independence Hall, and Amish Country, there is much for families and individuals to experience.

Pennsylvania is also home to two of the largest cities in America: Philadelphia and Pittsburgh. You can’t go wrong with an outing to watch the Eagles and Steelers or the Phillies and Pirates battle it out on the football and baseball fields!

The state was the site of many historical events in America. Its Museum of the American Revolution contains exhibits, including George Washington’s War Tent and the first 13-star American flag. You can also pay a visit to the Betsy Ross House in Philadelphia, where the original owner created the first American flag.

No trip to Pennsylvania is complete without a visit to Independence Hall in Philadelphia. Independence Hall is where the Declaration of Independence and the U.S. Constitution were first signed. Visitors can also see the famous Liberty Bell and view Ben Franklin’s postal office.

While there is no shortage of things to see in Pennsylvania, the state is not known for being cheap. Residents of Pennsylvania — especially those living in large cities — are often struggling with expensive rents and high transportation costs.

Many residents try to mitigate the rising cost of living through bank loans and often find themselves stuck with large debt burdens. As a result, some people in the state of Pennsylvania may find themselves in need of help with their debt payments.

*** SPECIAL NOTE *** – If your credit cards, personal loans, or medical debts have become unmanageable and you owe over $20,000… then go here for debt relief. We can help!

The Lowdown On Pennsylvania Debt

US Census Bureau data suggest that the cost of living in Pennsylvania is much higher than in other states. With an average cost of living index of 102.5, residents struggle with exorbitant grocery and utility expenses, while the median household income is $67,587. Households in Pennsylvania’s most prominent cities face mounting rent costs that have only grown due to inflation.

Surprisingly, Pennsylvania workers have lower wages than those in other states.

The median salary for a Pennsylvania employee is $55,490, compared to the national average of $58,260.

According to Pennsylvania debt statistics, residents of Pittsburg carry an average of $9,333 in credit card debt. Those living in Philadelphia do not fare much better: the median household credit card debt for those in city limits is $8,697 whereas residents nationwide have $8,425 in credit card liabilities.

The combination of lower wages and high cost of living leads to people seeking solace in credit card loans. However, once they take on a loan, it can prove difficult to pay it off, especially when making minimum payments.

Use the handy calculator here to see how long it will take to pay off your creditors when you make only minimum payments.

What Happens When You Make Only Minimum Payments?

Banks make their money by charging interest on any loan. You pay interest for borrowing any money, whether it is for buying a car, housing, or to cover your everyday expenses.

Credit cards have the highest interest rates compared to mortgages, personal loans, and car loans.

Minimum payments are calculated based on the outstanding balance. The amount of the minimum payment goes hand-in-hand with the balance: the higher the balance, the higher the minimum payment.

However, when you only pay the minimum payment, you are basically paying more in interest rather than part of the money you have borrowed. The credit card balance hardly budges and it takes years to repay the full amount you have borrowed. If you continue using your credit card, the balance increases even further and you are trapped in ballooning credit card debt.

As one of the most reputable companies in Pennsylvania, Americor certified debt specialists are here to help any Pennsylvanian move out of minimum payments and back on track to financial wellness and free of debt.

As part of the services we provide, we will help you find debt relief, and provide information on all you need to know about available debt relief options in Pennsylvania and on matters concerning debts from credit card bills and medical bills. We can also advise you on unsecured debts, reducing interest rates, student loan debt, payday loans, the statute of limitations on debt, wage garnishment, debt collectors, fees and interest, and ways to achieve debt reduction.

What Is Credit Card Delinquency?

When you fail to pay the minimum payment on your credit card, your credit card is categorized as delinquent. After two consecutive months of not making the minimum payment, the bank can increase the interest rate on your credit card. If you continue to fail to make any payments, you risk losing access to your credit card and your debt will be channeled to debt collection companies.

Delinquency impacts your credit score negatively. With a lower credit score, it becomes more difficult to apply for a loan. Banks may charge you higher interest for not having a good credit score.

What Causes Credit Card Debt In Pennsylvania?

It is not difficult to amass credit card debt. The high cost of living and low salaries are a lethal combination for households.

Low Income in Pennsylvania

Low income is a major source of credit card debt in Pennsylvania. When your income does not cover necessities such as groceries, utilities, and fuel, it makes sense for you to turn to your credit cards to finance your needs.

Many people who live paycheck to paycheck often find it hard to make ends meet at the end of the month and turn to their credit cards to cover their everyday needs.

When this goes on for a period of time, the credit card balance increases. If you only make minimum payments, the outstanding balance barely decreases and you soon find yourself in credit card debt, and unable to make your card’s monthly payment.

If this is you, contact us now and get started on your journey to financial wellness by taking advantage of Americor services.

Unforeseen Expenses

Life is unpredictable. You can hardly predict that the fridge is going to break down or that a sudden storm can tear parts of your home’s roof.

Unforeseen expenses can wreak havoc on a household budget. When you are on a low income, it is very difficult to save money for an emergency fund. When an emergency hits a household, people often turn to their credit cards to finance the expense.

It can, however, be difficult to repay a debt that keeps on piling up with interest charged by the bank.

Credit Card Debt Relief In Pennsylvania

Luckily, there are plenty of options for credit card debt relief in Pennsylvania. With the help of Americor’s debt specialists, you can look forward to a stable future without debt crippling your life.

Credit Counseling

The first step to Pennsylvania debt relief is seeking credit counseling.

Americor offers credit counseling to help you understand your current financial situation. We go through your income and expenses and see how we can create a viable plan that works for your household.

Small changes in your lifestyle can make a huge impact on your expenses, leaving money to repay your credit card debt. For example, you can switch to a cheaper utility company or you can bundle expenses together for a better price.

Our Americor debt specialists will help you with budgeting, financial planning, and money management. We will go through debt repayment strategies to find the one that fits your needs and your level of debt. The goal is to achieve debt relief within reasonable lifestyle constraints.

Debt Consolidation Loans

It is quite common to have several credit cards with outstanding balances. If your credit score is high enough, you can negotiate a low-interest debt consolidation loan that will be used to pay off all your credit card debts. Such a loan acts as an umbrella loan. You only have to pay this low-interest loan for the amount of time agreed with your bank.

The benefit of debt consolidation loans is that they are low-interest compared to credit cards. It is also much more practical to monitor and make monthly payments on a single loan rather than multiple credit cards with varying balances and minimum payments.

However, a debt consolidation loan works best if you stop using your credit cards, otherwise, you risk finding yourself in the same position a few years down the line. You have to make sure that you keep up with the loan payments and pay attention to their terms and conditions.

Debt Settlement

In debt settlement, Americor’s debt specialists negotiate on your behalf with your creditors to reduce the amount of debt you owe them.

Debt settlement takes into consideration the amount of debt you owe along with your income, expenses, and overall credit score. Debt settlement usually reduces your credit card debt by 25 to 50%.

Debt settlement has a negative impact on your credit score but with sound financial management, you can regain lost ground.

Debt Management

Americor’s certified debt specialists can create a debt management plan for your debt.

This type of debt relief helps you manage your debts on friendlier terms. Americor negotiates with your bank a lower interest rate on your debt. If you were delinquent on your minimum payments, debt management can waive the late fees and reorganize your debt into more manageable payments that fit your income.

The goal is for the bank to get back its money and for your household to have an easier payment schedule on favorable terms. Debt Management Plans (DPMs) are custom-crafted to fit each of our client’s financial circumstances.

Bankruptcy

In some cases, bankruptcy may be the best option for Pennsylvania debt relief, if all other options are unachievable.

Bankruptcy involves a lengthy legal process. You have to take your case to the court with the help of an attorney who will present your case and verify your inability to repay all your debts. Bankruptcy can reduce your level of debt or discharge it completely, and you may have to sell part of your assets.

Declaring bankruptcy will have a negative impact on your credit score and you may find it difficult to secure a loan.

Talk To An Americor Specialist

Americor understands the financial troubles of Pennsylvania residents. We offer several programs for Pennsylvanians seeking a fresh start. To learn more about our services and the help we offer on Pennsylvania debt, check out the following links:

As America’s trusted source for debt relief solutions, we aim to empower you with financial knowledge that can lead to informed decisions, whether it’s about savings, investments, or managing debt.

If your debt has become unmanageable and you have difficulty making your debt payments each month, then you should consider a FREE consultation call with one of our certified Debt Consultants, who can provide personalized debt relief advice tailored to your specific needs.

By taking proactive steps today, you can put an end to your financial stress and work towards a brighter financial future.

Remember, there is always hope for debt relief, and our team of experienced professionals are ready to guide you on your journey to regaining control of your finances.

For more information on Americor’s debt relief services, contact us today to see how we can help you eliminate your debts, and get on the fast-track to becoming completely debt-free!

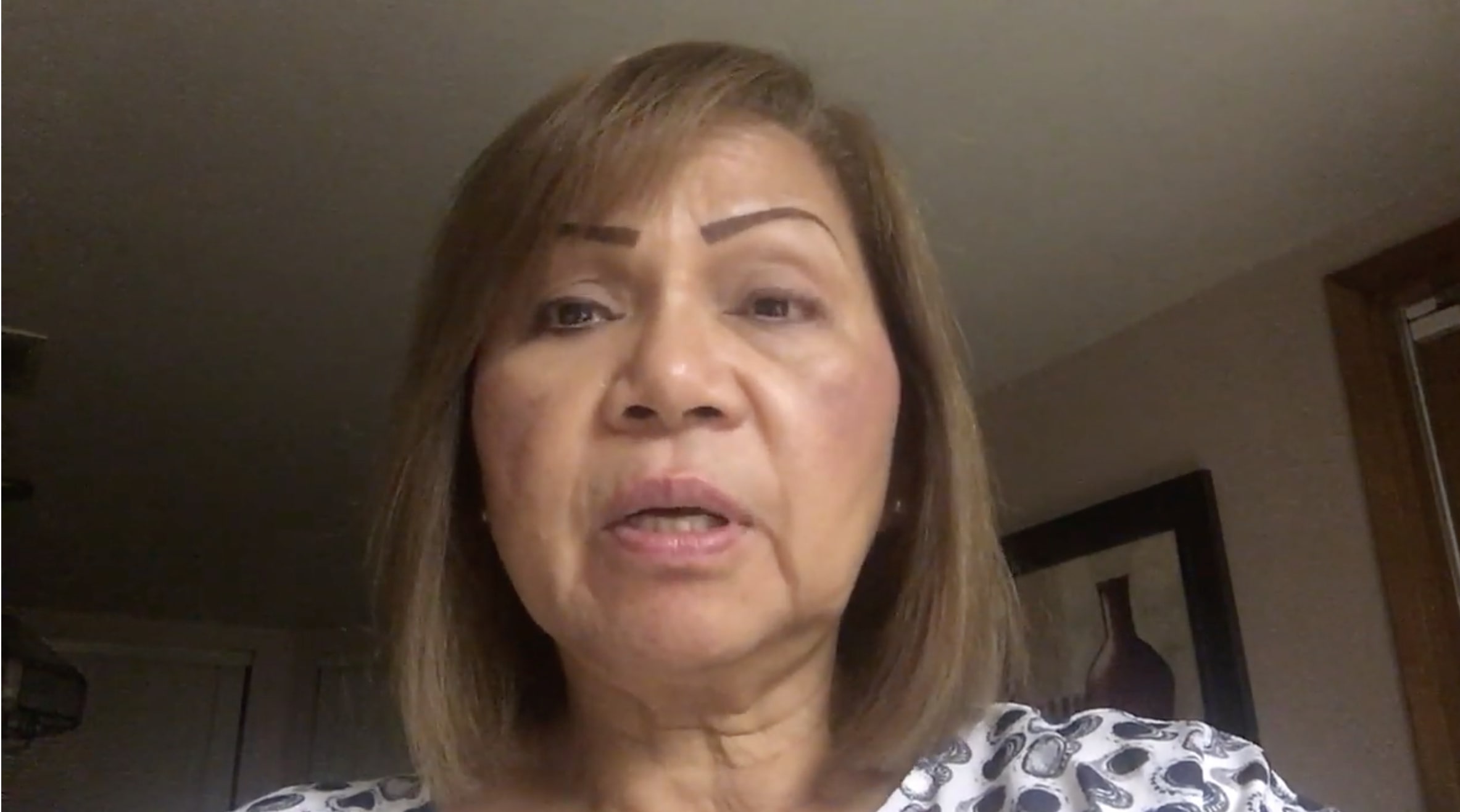

“In 2020, I was drowning in debt. I enrolled in Americor for my 10 creditors for $110,000… and today (three years later) I have cleared my entire balance. It was not an easy process, but Americor guided me through and I am debt free!”

“I was down $80k in business debt, and I remember hearing Americor radio advertising. My credit score was down to 570 from 810. I’ve been in the program for over 3 years. It works, just be patient. And my credit score is currently back up to 710!”

We’ve Helped Thousands

of People Just Like You

Julia S.

“Before Americor, we were having a difficult time trying to make our minimum payments. We were over $50,000 in debt with 11 credit cards. Americor negotiated with our creditors and reduced our debt in half!”

Pennsylvania Debt Relief FAQs

The first step in determining whether you are eligible for debt relief is to assess your current situation. You should look at the amount and type of debt you owe. Some types of debt, such as student loans or taxes, may not be eligible for debt relief programs. You should also review your income to see if it meets the requirements for certain debt relief programs.

Contact a professional financial planner or credit counseling service who can help you determine the options available to you and what steps need to be taken in order to get approved for a debt relief program.

The amount you can save by enrolling in a debt relief program will depend on a few factors, such as the type and amount of debt you have, your current financial situation, and the program’s terms.

Generally speaking, debt relief programs can help lower your monthly payments and/or reduce the amount you owe. This can lead to significant savings in both the short and the long term. To get an accurate estimate of how much you could potentially save with a debt relief program, it is best to speak with an expert who can assess your situation and provide specific advice.

Imagine life completely

free of debt!

or call the number below to speak with

a certified Debt Consultant today: