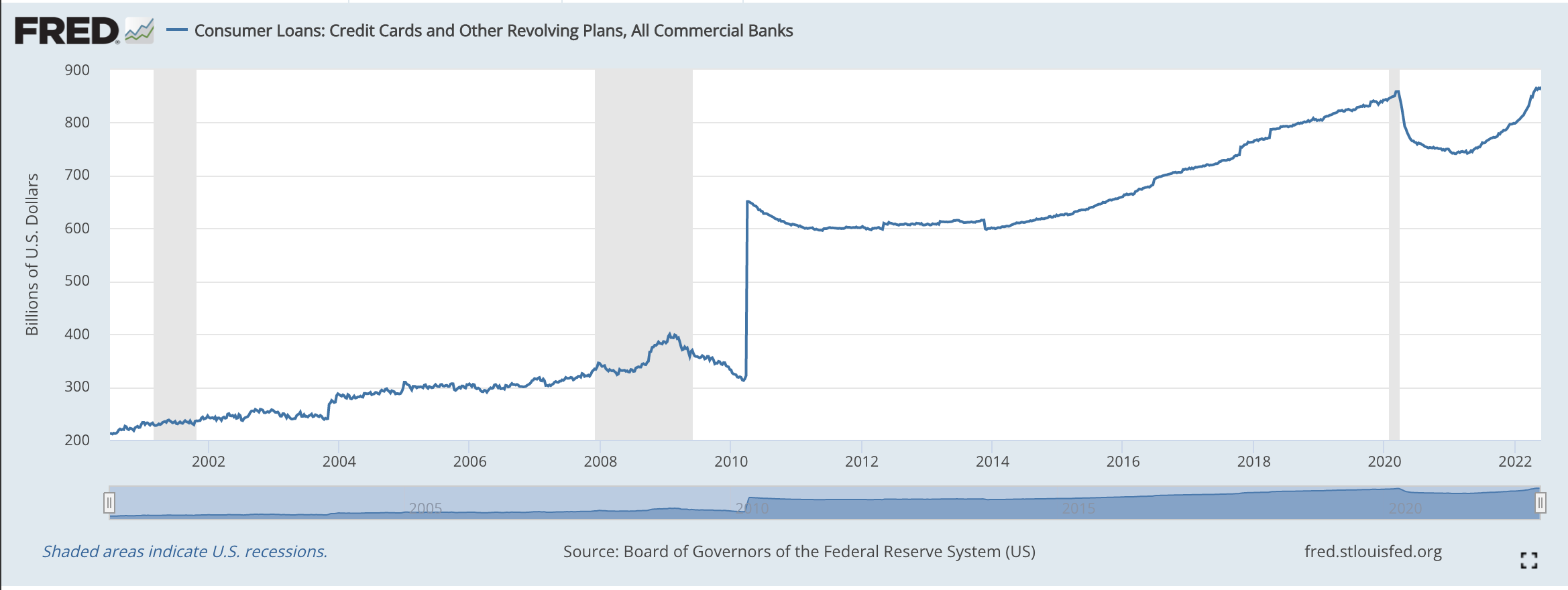

Americans have been swiping their credit cards more in the last few months.

During the pandemic, many relied heavily on credit cards, leading to near-record consumer debt levels.

The Federal Reserve reports that as of March 2022, consumer debt is up to over $52 billion.

Credit card debt surged by over 21 percent as card companies have increased interest rates and fees.

Growth of the Credit Card Payment Market

Credit Card Payment is a convenient payment method that allows customers to pay for purchases with a plastic card instead of cash or checks.

With a credit card, you can pay for goods and services without having to immediately provide your bank account details. By borrowing funds to pay back to the credit card company later, you avoid the hassle of carrying wads of cash and waiting for days before receiving your funds.

The Global Credit Card Payment Market has witnessed tremendous growth over the last few years due to the growing adoption of online transactions across many industries.

The market was valued at $477.5 billion in 2021 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.4 percent to reach a value of $732.8 Billion by 2028.

While the booming market is helping drive record banking industry profits, it could become increasingly costly for consumers. This is especially true for cardholders with lower credit scores.

Key Credit Card Statistics

- Americans’ total credit card balance is $856 Billion

- Over 80 percent of American adults have at least one credit card

- The average American has 3.84 credit cards

- Cashback credit cards are the most popular type of credit cards

- The average household’s credit card debt is just over $5,300

- New Jersey and Alaska consumers have the most and least credit card accounts, respectively

Rising Interest Rates

According to CreditCards.com, the average interest rate is 16.58 percent, near a record high.

The Federal Reserve recently began fighting inflation by pushing up the federal funds rate by a historic half of a percentage point. This caused the national average credit card APR to soar to a rounding distance of 17 percent – its highest point in more than 2 years.

Federal Reserve policymakers pointed out that their decision was justified due to declining unemployment, robust job growth, and historic inflation, which has so far proved tough to tamp down. Their goal is to help push inflation closer to 2 percent. Inflation currently stands at 8.5 percent – the highest it’s been in 4 decades.

Several banks, including Wells Fargo, American Express, Citibank, Huntington, U.S. Bank, and Key Bank, responded to the Fed hike with half-point increases of their own.

Interest rates are poised to climb even higher as more card companies catch up to the Fed hike and revise their APRs.

Tips to Get a Low Credit Card Interest Rate

Improving your credit score will increase your chances of getting approved for a credit card lowest rate.

To secure a low APR:

- Pay your bills on time

- Build a lengthy and diverse credit history

- Keep your credit utilization ratio low

- Monitor your credit report for errors

- Negotiate a lower APR

- Avoid credit card overspending

Credit card debt remains a big problem for many Americans. Debt repayment is a very important part of rebuilding your financial life. If you’re experiencing trouble paying down debt, we offer debt relief solutions.

Click here to apply: https://apply.americor.com/new