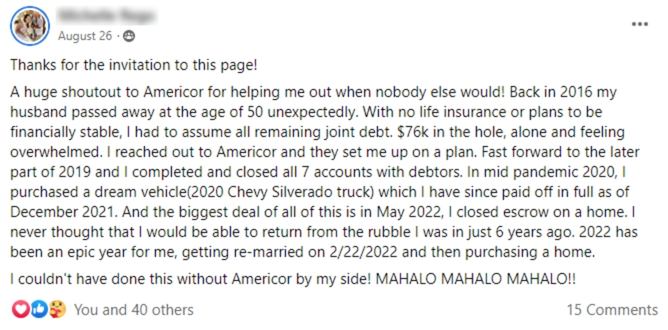

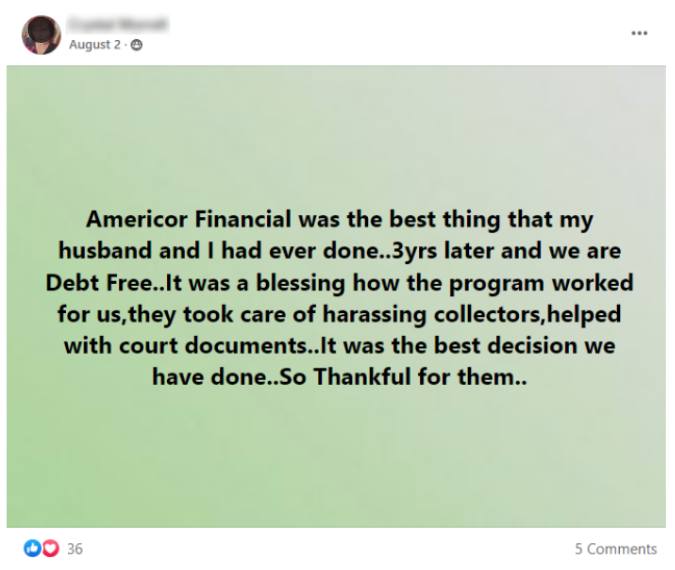

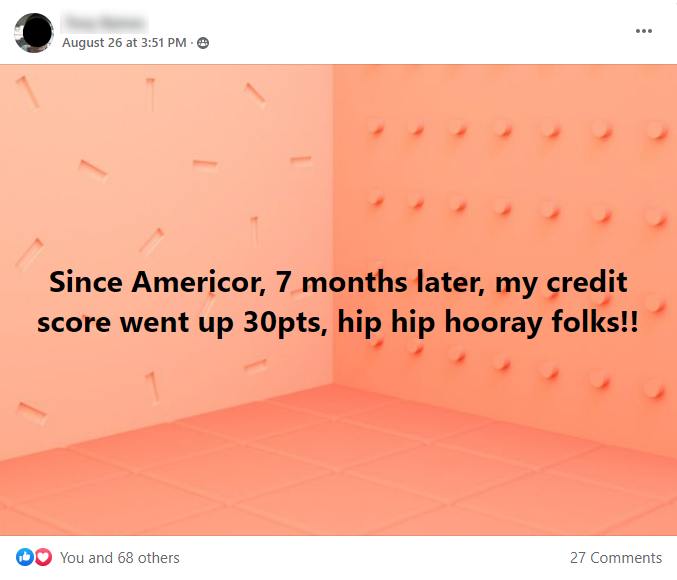

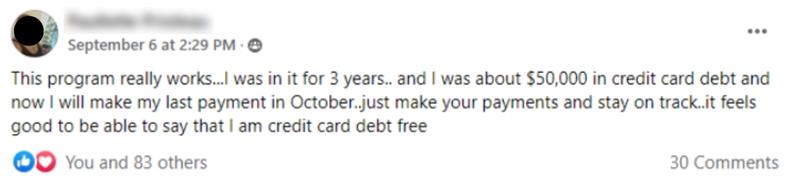

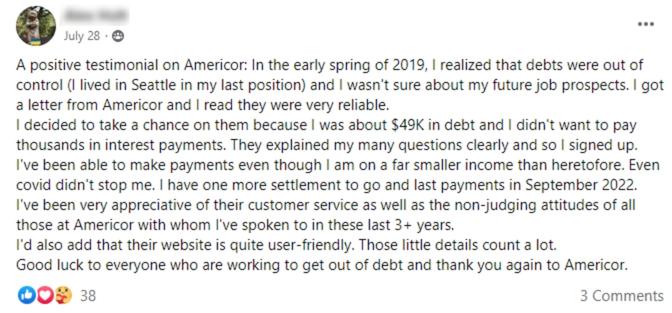

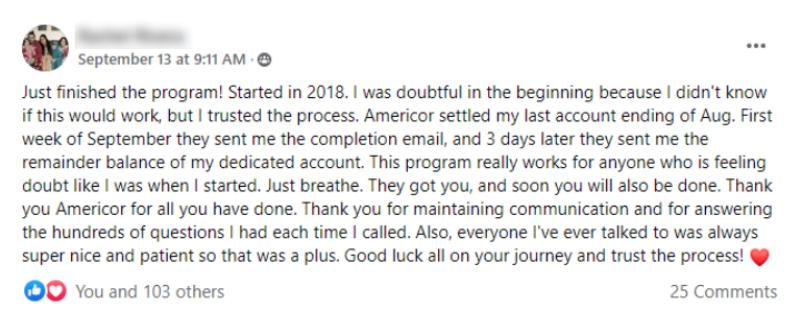

Client Stories

Each person who becomes an Americor client brings their own unique story about how they have suffered financial hardship resulting in unmanageable debt. And we help them transform their story to one of success and freedom from debt!

Total Debt Relieved

$2+ Billion

Americans Empowered

200,000+

4.9

15,500+ Reviews

Featured Client Story

High Credit Card Debt With Nothing To Show For It

Phillip, a divorced father of four, was in trouble financially… until he found Americor.

Watch Phillip's StoryAmericor Employees Using

Our Debt Relief Program

Dorrie Used Americor’s Program For Her Own Debt

Americor not only allowed me to help make a difference in people’s lives, but they also helped me become debt-free!

Watch Dorrie's StoryJeanette Helped Her Mother Become Debt-Free

I got my mother into our debt relief program and now she’s debt-free. It’s exciting to be part of such a forward thinking company!

Watch Jeanette's StoryJordan’s Parents Enrolled In The Americor Program

As an employee at Americor, I knew the program would help my parents become debt-free… and it did!

Watch Jordan's Story