The Two Shocking Downsides To Only Making Minimum Credit Card Payments

If you’re only making minimum payments, you’re not alone… but there’s a serious financial price to pay!

Many credit card users set their accounts to autopay their minimum payment and go on spending.

Paying $25 or 1% to 2% of your balance every month sounds easy… because it is.

That’s why 45% of millennials are only making their minimum payments.

*** SPECIAL NOTE *** – If your credit cards, personal loans, or medical debts have become unmanageable and you owe over $20,000… then go here for debt relief. We can help!

This set-it and forget-it attitude allows you to dodge late fees and keep your account in “good” standing… but that’s about it.

Unless you’re in a serious financial crisis and you need to save cash for a couple of months, only paying your minimum payment is a poor financial strategy that could end with devastating financial consequences.

You’ll Pay A Lot In Interest Charges Over Many Years

Credit card interest charges are determined as a percentage of your outstanding balance. The larger your balance, the greater your interest charge.

By only making minimum payments, the total interest increases each month and your balance snowballs, especially if you continue making charges to the card.

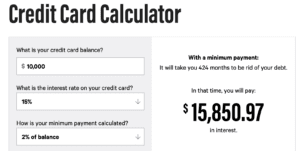

Say you owe $10,000 in credit card debt with 15% interest, and you’re making a 2% minimum payment ($200) each month.

Here’s how many years and dollars you’ll spend before your card is paid off:

That’s 35 years and $25,850.97 to pay off a $10,000 debt – and the $15,850.97 in interest is more than you owed in the first place!

Check out this online credit card calculator to calculate how much interest you’ll pay and how long it will take to pay off your debt.

If you take a look at the “Minimum Payment Warning” on your bill, you’ll find a table telling you how long it will take you to pay your balance by only making minimum payments.

The longer you take to pay down your debt, the more interest you’ll rack up, and the more money you’ll end up spending.

Your Credit Score Will Suffer

The percentage of the credit you are using is known as your ‘credit utilization ratio’.

This metric has a major impact on your credit score, which is why keeping a high balance is not a good idea.

The typical suggestion is to use less than 30% of your credit limit per card.

But if you’re only making minimum payments, that means you’re using a larger percentage of your allowed credit, which will negatively impact your credit score.

Remember, a poor credit score will make it more difficult to qualify for loans and other credit cards. It can even impact your job prospects and your ability to rent an apartment.

Can’t Afford to Pay More Than Your Monthly Payments? Ask for Help!

Paying more than your minimum credit card payment is not only beneficial but critical to your financial health.

However, some of us are stuck between a rock and a hard place and simply can’t afford to pay off more of our debt.

At Americor, we understand the unique financial challenges people are facing today.

As America’s trusted source for debt relief solutions, we aim to empower you with financial knowledge that can lead to informed decisions, whether it’s about savings, investments, or managing debt.

If your debt has become unmanageable and you have difficulty making your debt payments each month, then you should consider a FREE consultation call with one of our certified Debt Consultants, who can provide personalized debt relief advice tailored to your specific needs.

By taking proactive steps today, you can put an end to your financial stress and work towards a brighter financial future.

Remember, there is always hope for debt relief, and our team of experienced professionals are ready to guide you on your journey to regaining control of your finances.

For more information on Americor’s debt relief services, contact us today to see how we can help you eliminate your debts, and get on the fast-track to becoming completely debt-free!