South Carolinians Are Tightening Their Purse Strings

Whether you want to escape to the seaside, learn about our nation’s rich history, hike the Appalachian Mountains, or enjoy a night out on the town, South Carolina has it all. From the charming city of Charleston to the sun-soaked shorelines of Myrtle Beach, the Palmetto State has something for everyone.

Sadly, all of that variety comes at a cost. South Carolinians are tightening their purse strings.

With home prices statewide spiking by 20.8% and grocery prices among the highest in the nation, South Carolina debt is on the rise.

Residents of South Carolina Are Struggling With Debt

With the cost of living rising every day, South Carolinians are struggling to make ends meet. In Columbia, the average household is $12,421 in debt. One hundred miles away, Charleston residents are burdened with an average household credit card debt of $12,147. By continuously charging their household essentials to their credit card and only making the minimum monthly payment, families are caught in a never-ending loop. Being debt-free may seem impossible.

Freedom From Debt In South Carolina

If you want to significantly decrease your debt, use our tools to get rid of your loans, including:

Sources:

https://www.redfin.com/state/South-Carolina/housing-market

https://wpde.com/news/local/study-south-carolina-among-states-with-most-expensive-groceries-leading-into-thanksgiving

https://wallethub.com/edu/cc/credit-card-debt-study/24400#average-debt-decrease-b

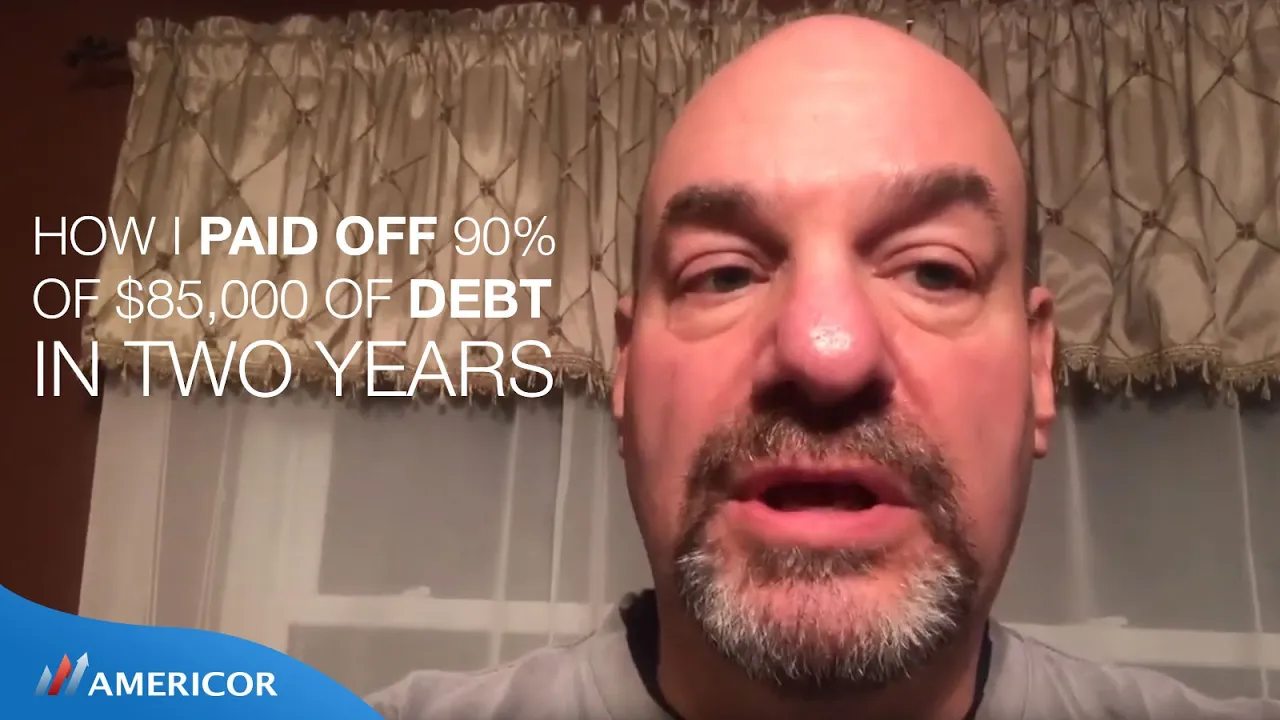

Our Clients Say...

-

Lannie D.

“In 2020, I was drowning in debt. I enrolled in Americor for my 10 creditors for $110,000… and today (three years later) I have cleared my entire balance. It was not an easy process, but Americor guided me through and I am debt free!”

-

Matthew E.

“I was down $80k in business debt, and I remember hearing Americor radio advertising. My credit score was down to 570 from 810. I’ve been in the program for over 3 years. It works, just be patient. And my credit score is currently back up to 710!”